Hengqin takes the lead in Guangdong in offshore digital RMB tax payment

According to the taxation bureau of Guangdong-Macao In-depth Cooperation Zone in Hengqin, Hengqin has taken the lead in Guangdong in offshore digital RMB tax payment.

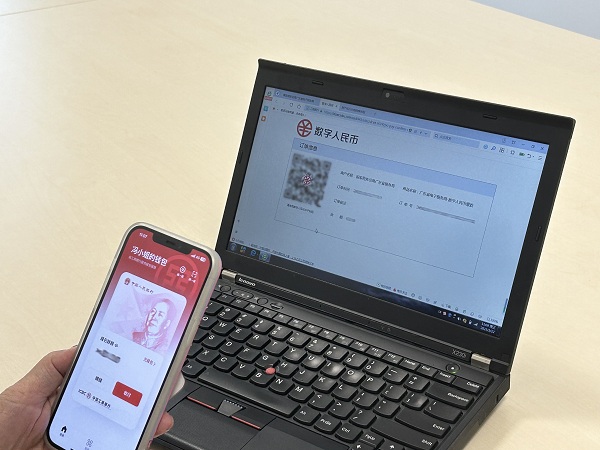

"Using digital RMB to pay taxes is convenient and secure. We can pay directly in Macao through our mobile phone," said Ms Fung, a Macao resident.

Recently, Ms Fung logged on to the online platform of the Guangdong Provincial Tax Service and declared a stamp duty to the taxation bureau of Guangdong-Macao In-depth Cooperation Zone in Hengqin. She used the digital RMB wallet opened in the Mainland and successfully paid the tax. This marks a new breakthrough in the application of digital RMB in the taxation field.

The tax authorities of the zone are also actively promoting the application of digital RMB tax payment among foreign-funded enterprises. Ms. Chen, a financial officer of Zhuhai Hengqin Bringbuys Network Technology Co., Ltd, declared VAT and additional taxes of approximately RMB 79,000 on the online platform of the Guangdong Provincial Tax Service. She also successfully paid the taxes using a digital RMB wallet, becoming the first example of a foreign-funded enterprise using digital RMB to pay taxes.

According to the officer of the cooperation zone’s tax bureau, in the pilot areas for digital RMB, individuals only need to register and log in to their digital RMB accounts using their mainland mobile phone numbers and make tax payments. For corporate taxpayers, they can pay taxes and fees by simply opening a digital RMB wallet at an online bank and logging on to the e-tax bureau to sign a tripartite agreement authorising the online transfer of taxes (fees).

It has been learned that compared to other third-party digital payment methods, the application of digital RMB to pay taxes and fees has stronger legal protection and obvious advantages such as convenient payment and real-time arrival, zero fees and cost savings, as well as support for offline payment.

Next, the Guangdong Provincial Tax Service will focus on serving the collaborative high-quality development of the regional economy in the Guangdong-Hong Kong-Macao Bay Area, deepen the reform of tax collection and administration and continue to optimize the tax business environment. The bureau will also further promote the payment of taxes in digital RMB and enrich the application scenarios of digital RMB in the field of taxation.