(Source: Executive Affairs Bureau of the Guangdong-Macao In-depth Cooperation Zone in Hengqin)

The General Plan for Building the Guangdong-Macao In-depth Cooperation Zone in Hengqin confirms that for tourism, the modern service industry, and high-tech enterprises established in the cooperation zone, the income from new overseas direct investment is exempt from corporate income tax. This policy has gradually promoted the influence of Hengqin as a platform for activating Macao's economy.

Qualified "going global" enterprises can keep relevant documents for verification during annual corporate income tax settlement; thus, the tax exemption policy applies without declaring in advance.

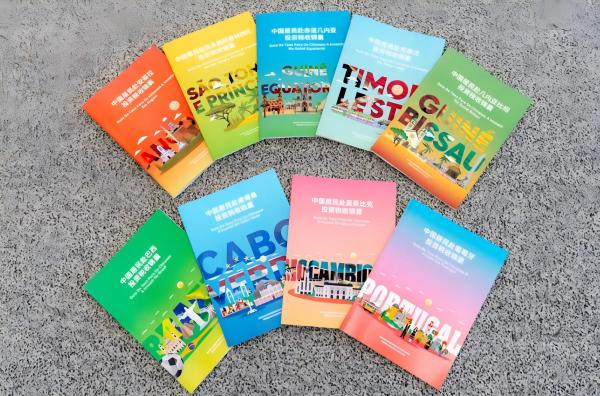

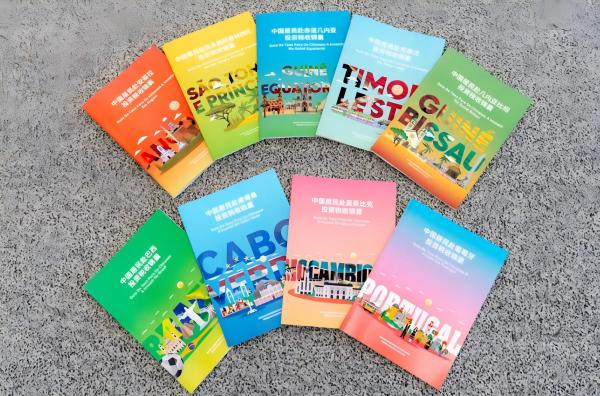

A tax service station and a multilingual tax service zone are established in the Centre for Science and Technology Exchange and Cooperation between China and Portuguese-speaking countries (CSTCP), located in Hengqin. The tax service provides professional, refined, and personalized international tax services, offers advice for Chinese residents' tax and investment in Portuguese-speaking countries, and continually improves the precision of the global process of Hengqin and Macao enterprises.

Strengthening international tax cooperation helps "going global" enterprises reduce risks in cross-border taxation. The tax service has held more than 30 tax advocacy activities for Hengqin and Macao enterprises to create a good environment where tax services help enterprises go global. Training and discussion sessions for finance and tax officials from Portuguese-speaking countries were also held to reach a consensus that working together is necessary to facilitate trade between China and Portuguese-speaking countries.

Hengqin tax authorities will strengthen communication and cooperation on tax affairs with Portuguese-speaking countries and optimize the cross-border tax service system to assist enterprises in "going global."