Xinjiang harnesses wind power to build clean future

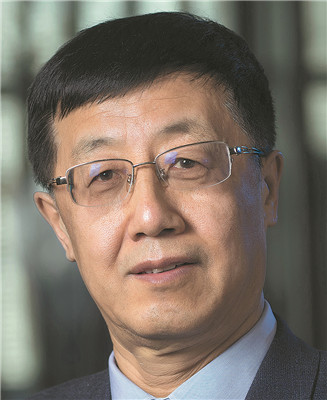

Wu Gang, entrepreneur in wind power industry

Fast-forward to 2013, Wu's Goldwind was China's largest manufacturer of wind turbines and the world's second largest, with more than 10 percent of the global market share. It had installed more than 14,000 turbines and had a presence on every continent except Antarctica.

Today, Goldwind ranks second only to Denmark's Vestas among global wind turbine makers, with its business covering 38 countries and regions across the world.

Wu attributed the success and rapid rise of China's wind power industry to strong engineering skills, and an ability both to acquire technology from other companies and develop its own technology.

The rapid growth of the wind industry at home and abroad has provided a critical boost, together with the backing of Chinese national policies, he said.

Thanks to the joint efforts of Goldwind and its peers, China's wind turbine output now accounts for two-thirds of the world's total due to its large-scale production and technological breakthroughs.

The turbine industry used to be dominated by foreign manufacturers, including Vestas of Denmark, Gamesa of Spain and GE of the United States. However, according to the Global Wind Energy Council's annual supply-side data, Goldwind is the second-largest global turbine supplier with 11.8 percent, after only Vestas with 17.7 percent of new installations in 2021.

Out of the global top 15 wind turbine suppliers last year, 10 come from China, and two Chinese companies made the top 5, it said.

An analyst said China has risen from being a novice to a pioneer in the wind power industry, with huge progress in localizing wind power technology.

Wind power has developed in leaps and bounds in China over recent years, as it plays a crucial role in fulfilling the Chinese government's pledge to achieve peak carbon dioxide emissions by 2030 and carbon neutrality by 2060, said Wei Hanyang, a power market analyst at research firm BloombergNEF.

Attractions

Attractions Dining

Dining Culture

Culture