Transitional Changes and Rebalance of China’s Economy

Aug 14,2015

By Yu Bin & Wu Zhenyu

Research Report Vol.17 No.4, 2015

With increasing pressure from economic downturn in recent years, China’s GDP growth rate has dropped from 10.6% in 2010 to 7% in the first half of this year. To avoid the plummet of GDP growth rate, guard against systemic risks, and win favorable opportunities for economic structural adjustment, the Chinese government has issued a number of short-term stimulus plans. Private sectors, however, fail to restore the enthusiasm for investment as before. As China’s economy expands on a large scale, policy effectiveness diminishes, and the economy continues its downturn. Therefore, the academia shifts its focus from studying the impacts of the international financial crisis on external demand to studying the changes in potential domestic growth rate. It has gradually recognized the objective law that an economy undergoes different stages of growth, and has understood and accepted the fact that China’s economy has entered into the new normal. Hence, policies gradually put both supply and demand on high agenda rather than only the latter one; more efforts are put into reform; steady progress can be seen in streamlining administration and delegating power to the lower levels, and an atmosphere of innovation and entrepreneurship becomes ever stronger.

In economic operation, changes of supply and demand affect each other; and macroeconomic performance and structural adjustment promote each other. It is necessary, among the factors with intricate casual relationships, to identify short-term fluctuations and trend-displaying changes, to distinguish major factors with significant impacts on the whole picture from minor ones, and more importantly, to locate the prime driving forces for the changes and the key points of these changes. For example, the added value of final consumption and of service industry account for a much higher share of GDP, which is considered as an important sign to optimize the structures of supply and demand. But the main reason lies in the declining investment and industry growth rate, rather than in the growth of consumption and the tertiary industry. Besides, the growth of investment and industry depends on the supply of production factors like labor, capital, and land and on the upgraded demand structure, etc. Retrospecting China’s economic adjustment after the financial crisis, we can find four important transitional changes that have played a key role and led to the decreased economic growth rate. Here are the four transitional changes. First, in 2012, China’s working-age population experienced negative growth for the first time. Second, in 2013, every household in the city and town possesses more than one residence. Third, in 2014, local governments suffered from so high debts that the State Council issued Document No. 43 to deal with the problem. Fourth, the growth rate of global trade fell below that of GDP in 2012, while the former exceeded by far the latter a decade before. The above four transitional changes have brought significant and lasting impacts to relevant markets and economic agents. Development of such changes not only plays a crucial role in affecting economic growth rate, price adjustment and structural change, but also determines the rebalance of China’s economy.

I. Four Major Transitional Changes in China’s Economy and Their Impacts

1. The decline of China’s working-age population exerts a fundamental impact on the supply and demand.

The year of 2012 first witnessed a net reduction of working-age population aged between 16 and 59 in China from the previous year. Since then, the working-age population has been shrinking by a certain margin every year. As of 2014, it has decreased some 9.6 million in total, 30% more than the number of college graduates that year. The cumulative effects of decreased working-age population gradually present themselves.

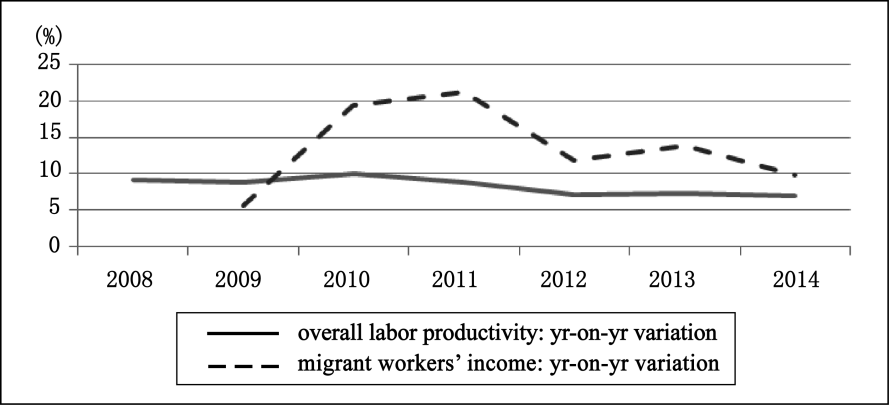

——Labor cost increases as working-age population reduces, which further affects the profits and competitiveness of enterprises. The number of migrant workers grows at a decreasing rate, which is the result of falling working-age population. The number of migrant workers increased by 5.4% in 2010 and only 1.9% in 2014. As a result, migrant workers enjoy fast pay rises, with an average pay rise of 15.2% from 2010 to 2014, 7.1% higher than the growth rate of overall labor productivity (see Figure 1). Migrant workers, the main force in China’s manufacturing industry, have incomes increasing at a rate sharply higher than that of labor productivity and economic growth, which squeezes the growth of enterprise profits, and makes China’s manufacturing industry less competitive internationally and less attractive to foreign investment.

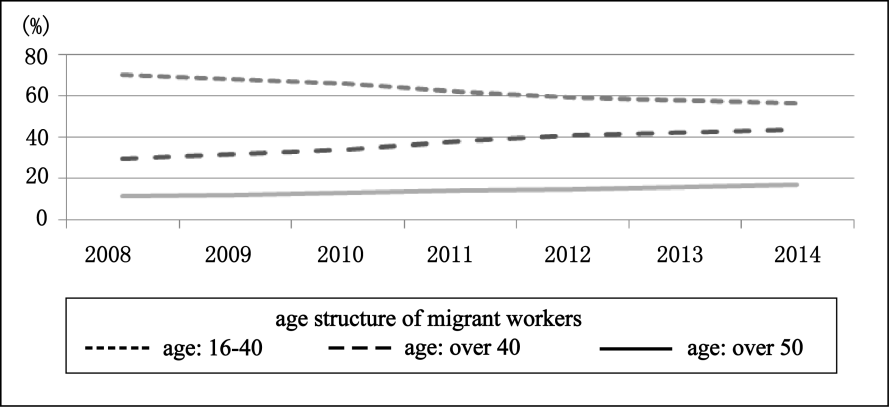

——As the average age of labor rises, the output efficiency of human capital lowers down. With the inadequate labor supply, enterprises would relax restrictionson the age of workers. Since 2008, migrant workers aged between 16 and 40 dropped to 56% of the whole group from the previous 70%, while those over 40 rose by 13.5%. Particularly, migrant workers over 50 years old rose by 5.7%. The change in age structure of workers actually reduces work efficiency.

——The capital-labor ratio has such a change that workers’ income accounts for a higher share in total revenue. As the working-age population shrinks, although there are still rural workers moving to cities and industry, trend-displaying changes are taking place in the capital-labor ratio. Wages rise faster than productivity; labor income has a rising proportion in the total revenue; and the pattern of national income distribution starts to be optimized. The expansion of service industry has somehow contributed to the increasing workers’ income, but the changing working-age population is the determinant judged from the time sequence (Figure 2).

Figure 1 Comparison Between Productivity and Migrant Workers’ Income Source: Wind Information.

Figure 2 Changes of Migrant Workers’ Age Structure Source: Wind Information.

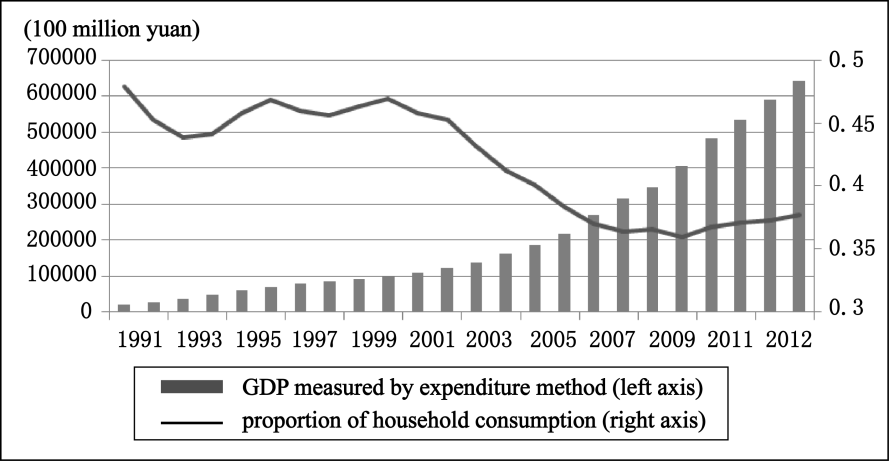

——Transitional changes in labor supply make it objectively necessary and practically feasible to transform economic development model. In China, fixed assets investment is mainly fueled by enterprises themselves. Rising labor cost, reduced enterprise profits, and limited capital sources, combined together, decrease the overall economic investment. In addition, rising workers’ income makes it possible that consumption boosts economic growth. Due to the rising wages and policies concerning social security and consumption, China’s household consumption began to account for a larger share of GDP measured by expenditure method in 2011 (Figure 3).

Figure 3 Proportion of Household Consumption in GDP Measured by Expenditure Method Source: Wind Information.

2. The real estate market is embarking on a trend of adjustment, which will affect the economic structure and industrial development.

With every household as the calculation unit, it is estimated that every household in China’s towns and cities had over 1.05 residences on average in 2013①. Although different organizations and scholars have different estimation when measuring the number of residence per household, the high-speed growth in the past decade or so has led to a colossal housing stock, which indicates limited growth for the real estate market. It has become a consensus that China is embarking on a trend of adjustment.

…

If you need the full text, please leave a message on the website.

①Liu Shijin, 2014: Building New Normal of Growth during Reform, China Citic Press, p44.