Bubbles in China's Economic Circulation

Jul 28,2015

By Chen Daofu, Research Institute of Finance of DRC

Research Report No. 118, 2014 (Total 4617)

I. The Nature of Bubbles Is Self-circulation Based on "Unreal" Elements

In nature, the bubble economy is a self-circulation based on separation. Based on some unreal elements (such as expectation for future price hike, some theories of assets price appraisal, derivative money that is not based on real savings, unreasonable implicit guarantees by governments, which are a kind of separation from the reality), the national economy forms in a certain local field a self-circulation system that is inconsistent with a bigger system, but can be maintained within a considerably long period of time through self-fulfilling mechanism, policy, system and organization. The self-circulation system excessively expands and occupies the resources of other structures of the system, and finally threatens the stable operation of the whole system. This kind of excessive expansion can manifest in the form of continuous price hike (price-type bubble) or continued increase of supply (quantity-type bubble).

Bubbles with an overall significance often appear in economic transition periods. It's easier for unreal elements to play a long-term role in economic transition periods. The economic growth of either forerunning developed countries or late comers does not evolve along a smooth curve; instead there are rotations between central countries (in view of the evolvement history of capitalism in recent 500 years, central countries often firstly undergo the period of commodity and service expansion, and then gradually decline in the financial expansion period, with rotations between different central countries1), and several phase shifts and transformations. During a transition period, the driving force of economic growth changes and the main social conflict changes, requiring corresponding adjustments to the growth mechanism. But people's understanding, macro policy, economic system and organization still stay on the original growth path, or artificially keep economic growth speed at the level of the preceding period with the help of relevant sectors such as some industrial investment sectors, realty, and even consumption sectors, easily causing unreal elements to play a continuous role. A representative developing country that is catching up with developed countries, tends to have bubbles during the shifting process of economic growth from a high speed to a medium speed and then to a low speed.

II. Three Self-circulation Bubbles in the Circulation of China's National Economy

Due to various kinds of subjective and objective causes, there are lots of separations at different levels in the operation of China's national economy, and these separations form three relatively important self-circulations, generating bubbles with macro significance.

1. Composition of international circulation bubbles: double surpluses – financial expansion of trade departments - foreign exchange reserve.

Firstly, China is a part of the consumption bubble circulation dominated by the United States and Europe. In 2002, with the U.S. IT bubble burst, the Federal Reserve greatly loosened monetary policy, causing consumption bubbles, and especially giving rise to the realty consumption bubble. After euro integration, some European countries have greatly increased the issuance of their treasury bonds, keeping their interest rate low, and expanding the consumption bubble including the realty bubble. China's export-oriented development strategy has got integrated into this world bubble chain.

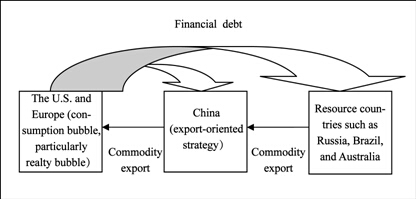

China imports huge quantities of resources and raw materials from resource countries, and manufactures and exports products to consumption markets in the United States and Europe. When emerging countries have achieved some development, and begun their infrastructure constructions, China would export large quantities of equipment to them. Economically China has imported and exported large quantities of products, creating huge trade surpluses, which have changed, under the current exchange settlement and sales system, into the money issued by banks and the central bank to export departments (when money supply aggregate is under control, money issuance by non-trade departments is suppressed to a certain extent). Under the specific exchange rate and foreign exchange administrative system, the money is converted into huge amount of foreign exchange reserve, which is invested in financial markets in the United States and Europe, bringing down their interest rate, providing them with the financial support for consuming products with borrowed money, and importing Chinese products. The special position of US dollar in the international monetary system and the unrestrained US dollar issuance (issue bonds with the help of the U.S. Treasury security and governmental institutions such as Fannie Mae and Freddie Mac) have enabled such a practice (Figure 1).

Fig. 1 International Circulation

This wave of global economic bubble is embedded in a new round of globalization. After the cold war, Russia participated in globalization, and countries with a large population including China and India also joined the global economic circulation, driving global trade and investment to a new high.

China has seized the opportunity provided by this round of globalization, participated in the globalization process, successfully completed the industrialization progress, and reduced China's pressure from over-capacity (but China has further expanded capacity in the fast globalization tide and created more excessive capacity while digesting the original capacity). At the very beginning, it is a win-for-all approach, but when it moves to a certain phase, globalization with the backing of bubbles, will bring negative impacts to the operation of China's economy. The negative impacts would become more aggravated when China fails to implement in time the transition from the export-oriented strategy to the domestic demand-oriented strategy.

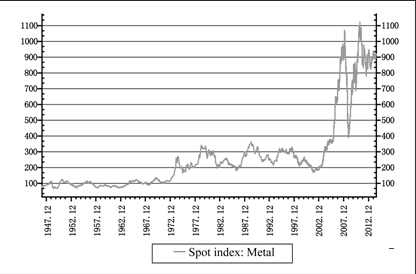

Specifically speaking, first, the global expansion is not sustainable. This round of globalization has got economies of major countries such as China, India and Russia involved in the world economy, and it seems no more country could follow these countries in terms of population and geographical size also to get involved. The globalization progress shows drastic fluctuations (such as the sharp fluctuation of growth rate). It's typically shown in the fact that bulk commodities experienced a super cycle. Weighed by metal price index in CRB Spot Index, this index was only 76.2 in 1947, and during the stagflation in the 1970s, it only rose from 120 to a little more than 300. But it had risen from less than 200 at the end of 2002 to 1,042 in 2008 within a short period of five to six years (Figure 2). Affected by the US financial crisis, the index made a quick correction, but exceeded in 2011 the peak of the previous period, reaching more than 1,100, and fluctuated at about 800 in the following four years. China had no choice but to bear the industrial challenges caused by such a huge change to globalization growth rate. The challenges find expression in excessive industry expansion brought about by adaptive expectations, other countries' vying for China's market share after global expansion became stable, and the relative decline of China's export competitiveness.

Fig. 2 Bulk Commodities "Super Cycle"

Source: www.windin.com.

…

If you need the full text, please leave a message on the website.

1For detailed analysis, see The Long Twentieth Century, written by Giovanni Arrighi, translated by Yao Naiqiong, Yan Weiming, and Han Zhenrong, 1st edition, January 2011, Jiangsu People's Publishing LTD, Phoenix Publishing & Media Inc.