Options for Coal Liquefaction Policy under High Oil Prices

Dec 09,2008

By Ma Mingjie, Department of Techno-Economic Research of DRC

Research Report No. 129, 2008

Since 2008, the international futures price of crude oil has been vibrating at a high level, falling back to over US$110 after topping US$147 on July 11th. Against the backdrop of high oil prices, coal liquefaction technology, as an oil substitute technology, has caught wide concern both at home and abroad. At the same time, there has been much controversy about the economic value, environmental pollution, resource pressure and energy security stemming from coal liquefaction industrialization. Based on international comparison and quantitative analysis, this paper provides some references for the positioning and policy of coal liquefaction.

I. Confronted with Market Risks, Coal Liquefaction Has Its Economic Value with High Oil Prices and Low Coal Prices

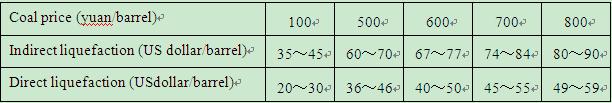

Results from the analysis of the economic value of coal liquefaction from the perspective of national economic development have shown that as long as the futures price of crude oil exceeds US$100 per barrel, the coal liquefaction, whether it is direct liquefaction or indirect, has its economic value. Even if the crude oil price drops to US$90 per barrel, so long as the coal price by no means tops RMB800 yuan per ton, the coal liquefaction still has its economic value (without considering CO2 emission). And the economic value of the direct liquefaction is more apparent than that of the indirect liquefaction ( Table 1).

Table 1 The Relationship between Coal Price and the Rock-bottom Crude Oil Price under the Economic and Workable Conditions

Note: CO2 emission is excluded.

Source: Shen Hengchao (Research Fellow from DRC): Analysis of the Economic Value of Coal Liquefaction.

From mid-March 2008 to early June, the liquidation price of Qinhuangdao 5000 kilocalories of coal was around 520~760 yuan/ton (The variety of coal is rigorously required for direct liquefaction, while indirect liquefaction is applicable to a wider range of coal. In addition, medium- and high-sulphur coal can be used for liquefaction. As there is a world of difference in prices of different kinds of coal and on different markets, this paper is only focused on the exposition of the liquidation price of the Qinhuangdao 5000 kilocalories of coal. Please refer to http://www.cqcoal.com). Based on such prices, so long as the crude oil price does not drop under US$74~84 /barrel, the coal liquefaction will have its economic value. Therefore, in the context of high oil prices, coal liquefaction, besides its economic value, has also left some room for the rise of coal prices.

Nevertheless, the drop of oil price, the rise of coal price and the increase of environmental cost will reduce the economic value of liquefaction.

Firstly, the rise of coal price will reduce the economic value of coal liquefaction. It can be seen from Table 1 that when the coal price is 500 yuan /ton and the crude oil price is US$60~70/barrel, the indirect liquefaction has its economic value. When the coal price stands at 800 yuan/ton and the crude oil price is US$80~90/barrel, the indirect liquefaction will show its economic value. The sensitivity of the direct liquefaction related to coal price is equally tangible.

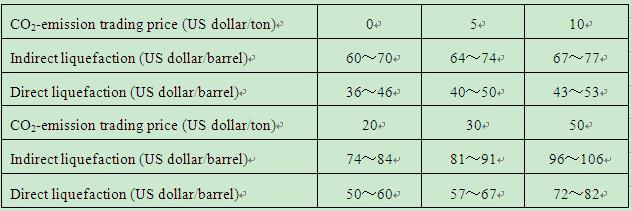

The increase of the environmental cost will also reduce the economic value of coal liquefaction. At the current CO2-emission trading price of US$10/ton, when the crude oil price is around US$67~77/barrel or more, the indirect liquefaction has its economic value. But if the CO2-emission trading price is increased to US$50/ton, the relevant crude oil price must reach US$96~106/barrel or more, the indirect liquefaction will then have its economic value (Table 2).

Table 2 The Lowest Crude Oil Price Related to the Changing CO2-emission Trading Price (Coal Price: 500 yuan/ton)

Source: Shen Hengchao: Analysis of the Economic Value of Coal Liquefaction,

II. High Coal-consumption Will Inevitably Affect the Economic Value of Coal Liquefaction through Pricing Mechanism

The high coal consumption in liquefaction has evoked much controversy. It is figured out according to the capacity target of 30 million tons of coal set forth in The Medium- and Long-term Development Plan for Coal Chemical Industry (draft for comments) that there will be virtually a prodigious amount of coal consumption in production of 30 million tons of liquefied coal. By indirect liquefaction, the 30 million tons will consume 135 million~174 million tons of water-free and dust-free coal each year. Take the year 2006 for example. The coal liquefaction alone accounted for approximately 7% of the total coal consumption in the same year (It is figured out that in indirect liquefaction 4.5~5.8 tons of water-free and dust-free coal will be consumed to produce 1 ton of oil products and 0.3~0.4 tons of such by-products as Naphtha and LPG and in direct liquefaction 3.0~4.0 tons of water-free and dust-free coal will be consumed to produce one ton of oil products and 0.4~0.5 tons of such by-products as Naphtha and LPG.), and for 15%~20% of the total coal consumption in the manufacturing industry. Coal consumption is also large in direct liquefaction. However, restricting the development of coal liquefaction due to the above-mentioned reasons is groundless.

According to the data released by the Ministry of Land and Resources in 2003, by the end of 2000 coal deposits after detailed exploration were 204.035 billion tons and out of that only 61.8 billion tons remained unused and the amount of coal deposits after detailed exploration available for mining by the newly-built medium- and large-sized mine shafts was only about 30 billion tons. However, China’s proven coal deposits have reached an accumulative total of 1021.056 billion tons and the coal supply can still be guaranteed by intensifying the efforts in coal prospecting. Besides, readjustment of the power structure can also save part of the coal resources for the liquefaction development. In general, consumption of resources is after all an economic issue. With the coal resources becoming more and more scarce, the pricing mechanism will unavoidably diminish the economic value of coal liquefaction and eventually make it become uneconomical.

III. Technological Risks Are the Primary Issues Affecting Coal Liquefaction in the Short and Long Run

At present, direct and indirect liquefaction technologies in China have gone through lab researches and put into operation for industrial trials. In terms of indirect liquefaction, the Institute of Coal Chemistry of the Chinese Academy of Sciences built and put into operation in 2002 an experimental plant of indirect coal liquefaction capable of producing synthetic oil of 1000 tons each year. The indirect liquefaction project invested by YKJT for the production of one million tons of indirect liquefied oil is still under preparation. In terms of direct liquefaction, at present only the industrial demonstration project of China Shenhua Group Corporation Limited is under way.

…

If you need the full text, please leave a message on the website.