Analysis on the New Round of Cyclical Fluctuation of Live Pig Supply in China

Dec 10,2007

Han Jun & Qin Zhongchun

I. An Overview of the Cyclical Fluctuation of Live Pig Supply in Recent Years

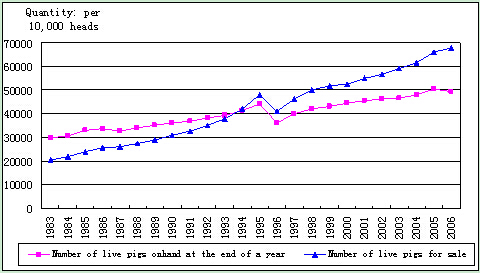

Reform of China's live pig supply market preceded that of grain market. Since 1985 when the government abolished the apportioned purchase of live pigs, opened meat market and introduced multi-channel operation, the national situation of live pig supply has improved a lot. With a view to the production of live pigs during the past over 20 years, except in a few years, the total amount of live pigs on hand and the number of live pigs for sale have shown a gradually increasing tendency year by year with no cyclical fluctuation between years (Figure 1), and the number of live pigs for sale has increased faster than that of live pigs on hand, showing the reduced raised period of pigs and the gradually improved efficiency of raising pigs. The period of pigs raising is mainly manifested in the fluctuation of live pigs' prices and the change of returns between profit and loss. Overall, the prices of live pigs from the end of the 1980s to the beginning of the 1990s didn't fluctuate much thanks to government regulation. Since 1995, both the market prices of live pigs and returns of raising pigs have showed an obvious cyclical fluctuation which has two characteristics: one is that prices show a periodic change within a year characterized by "high at the beginning and the end of a year and low in the middle" which is linked with the spring festival (China's lunar New Year) and other festivals; the other is that prices of live pigs also show a periodic change between years, if we set the lowest price as the bottom line and make an analysis according to the rise and fall in a period, the period usually lasts 2~3 years. When the market prices are high, the number of raised pigs would be increased, which would lead to the fast increase of supply followed by the fall of pig prices and even serious loss; after the loss continues for a period, the number of sows would be reduced rapidly and the supply of live pigs would drop quickly, and then the prices would go up again. In the live pig market, "cobweb phenomenon" is very typical. Live pig prices frequently go up and down and raisers are in a cycle of "earning in one year and losing in another", which has severely affected the development of pig-raising industry.

Over the past 10 years and more, China's live pig market has gone through three fluctuation cycles and now is in the high-price stage of the fourth cycle.

Figure 1: The number of live pigs on hand and for sale during 1983~2006

Note: The abnormal change of numbers in 1996 was due to the statistics methods adjustment in animal husbandry.

The first cycle was from the second half of 1996 until the first half of 1999, during which the restoration of live pig market was due to the rapid growth of national economy and pig price rose with brisk demand and rising consumer price. But from May 1998, the high returns of raising live pigs caused the number of live pigs on hand to exceed the normal need with supply exceeding demand, and coupled with Asian financial crisis, pig prices began to drop to the lowest point.

The second one was from May 1998 to the first half of 2003. During this period, the supply and demand in live pig market kept stable, basically remaining around breakeven point with small fluctuation, and the market performance rested on the supply and demand change. Therefore, this period saw a stable tendency – either by a small profit margin or a narrow loss margin, and the number of live pigs on hand maintained a reasonable level, except some time around 1999 when market suffered a serious loss. The lowest price in this period was due to SARS pandemic occurring in the first half of 2003 which had led to the obstruction of the transportation layout between provinces and the sharp fall of pig prices. During SARS occurrence, the number of live pigs on hand dropped sharply, especially the number of sows on hand. In addition, the impact caused by the "bird flue" resulted in a serious shortage of pig supply, incubating the fast rebound of pig prices in the wake of SARS epidemic.

The third cycle was from July 2003 to the first half of 2006. Immediately after SARS epidemic, the prices of live pigs rose sharply across the country, including live pigs, breeding hogs and pork. This attracted much of social capital into pig raising industry and also triggered the enthusiasm of farmers in raising pigs. The pig-raising scale expanded and the number of live pigs on hand increased greatly. The record high-profit period lasted two and a half years. Gradually, the supply of live pigs changed from adequacy to surplus and pig prices began falling from October 2004 until the first half of 2006 when the prices fell to the lowest level. China's Sichuan province in the western region is the largest province in terms of live pigs raising and selling in China and its market situation is quite typical. In the first quarter of 2006, the price of live pigs offered by Sichuan Meat Processing Factory stood at RMB 5.5 yuan per kilo, dropping by 44% than the average price of RMB 9.85 yuan per kilo in August 2004, more than 50% less than the highest price of RMB11 yuan per kilo. Pig raisers sold to pig peddlers at an even lower price of RMB 4.5 yuan per kilo. According to the estimation based on the investigation, at that time, to raise a pig to 100 kgs needed more than RMB 680 yuan, including the cost of feed RMB 546 yuan, plus RMB 140 yuan for the cost of hog breeding, epidemic prevention, water and electricity charges, fuel and labor force. If such a pig were sold at RMB 5.50 yuan per kilo, the net loss would be about RMB130 yuan. Although a farmer didn't calculate their labor cost and self-supplied feed, to raise a pig to 90kgs still needed more than RMB 520 yuan and the farmer would lose over RMB 115 yuan if the pig was sold at RMB 4.50 yuan per kilo. Given the fact that raising either breeding hogs or adult pigs could not earn money and even lose a lot, some raisers didn't breed or abandon their piglets; some others didn't supplement their pigs and yet some others killed sows. The production and sales of live pigs declined.

The fourth cycle was from the second half of 2006 when prices of live pigs began to pick up and after a few months they suddenly surged in April and May 2007 to the highest level in recent years. Now the cycle is in its high-price stage.

Figure 2: Prices of live pigs and young pigs and the changes of ratio between pig prices and grain prices , and between pig prices and pig feed prices

...

If you need the full context, please leave a message on the website.