China Should Not Become a Major Steel Exporter

Dec 13,2006

By Xu Hongqiang

Research Report No 215, 2006

In 1996, China’s steel production reached 101.24 million tons and became the largest steel producer in the world. In 2003, its steel production rose further to 222 million tons and became the only country in the world whose annual steel production exceeded 200 million tons. In 2005, China’s steel production shot up to 349 million tons, accounting for 30.9 percent of the world’s total. During the 1996-2005 period, China contributed two-thirds of the increased amount of world steel production, with the country’s share more than doubled. As China’s steel production and its share in world steel production went up, the country’s steel trade has also undergone some important changes. These changes both reflected the achievements of the development of China’s steel industry and also shown some issues to be worried about. In particular, the rapid growth of steel export was a phenomenon that urgently needs to be adjusted and changed. This article analyzes the problems of China’s steel production and trade, and puts forward some policy suggestions for improvement.

I. Major Changes Have Taken Place Related to China’s Steel Trade

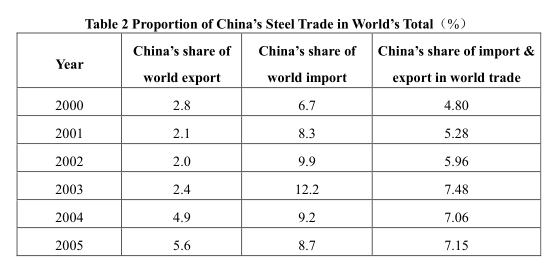

The rapid development of China’s steel industry is based on the rapid growth of the domestic market demand. But the growth of China’s steel production has considerably changed the supply-demand pattern of the world steel industry. While China’s steel production and the changes in its steel supply-demand relations have produced an increasingly greater impact on the world steel market through steel trade, steel trade has also become increasingly important to China’s foreign trade and to the development of the country’s steel industry.

1. China’s steel trade grows rapidly

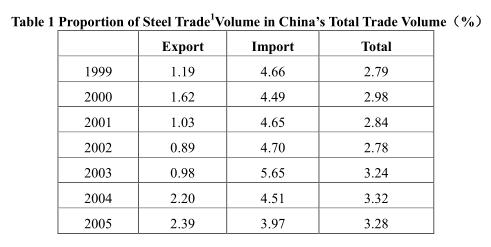

Since the Chinese economy entered a new round of growth in 2002, the country’s steel supply and demand and its steel trade have also grown rapidly. In 2002, steel import and export accounted for only 2.78 percent of the country’s total foreign trade. This share rose to 3.24 percent in 2003 and 3.32 percent in 2004. Although the share for 2005 was somewhat lower than in the previous year, it was still higher than that in 2003. In 2003, the added value of China’s steel industry accounted for 2.41 percent of the national GDP and the proportion of steel trade volume to the national trade volume was higher than that of the added value of steel industry to national GDP. In 2005, China’s steel export amount totaled more than 18 billion U.S. dollars and its steel import volume exceeded 28 billion dollars.

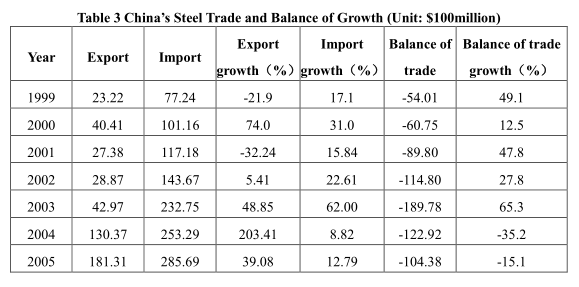

The rapid growth of China’s steel trade was driven by both export and import simultaneously. But in the past two years, the growth was mainly driven by the former. This was an important change in China’s steel trade, with the export growth outpacing the import growth. For long, China had been a net steel importer because there was a supply gap on its steel market and its steel products lacked international competitiveness. As a result, the country’s steel trade deficit became larger and larger. But this situation changed visibly as from 2004. In that year, China’s steel export skyrocketed by 203.41 percent while its steel import climbed up by only 8.82 percent. Accordingly, steel trade deficit stood at 12.29 billion dollars, 6.7 billion dollars less than the previous year. The deficit continued to decline in 2005 and is expected to drop to 8 billion dollars or less in 2006.

2. China has turned from a net steel importer to a net steel exporter

China had for long been a major steel importer. In 1996 when China became the world’s largest steel producer, the country’s net steel import totaled about 10 million tons. From 2001 to 2003, China’s steel import went up sharply driven by both the rapid growth of its domestic steel demand and the decline in international steel prices. In 2003, China imported a record high of 36.55 million tons of steel. In 2004, its steel import dipped to 13.83 million tons due to various reasons. In 2005, China turned from a net steel importer into a net steel exporter. Although the net steel export of 120,000 tons in that year was not quantitatively important, this change wasa symbolic event. It is expected that China’s net steel export will continue to grow in the next few years.

Although China has become a net steel exporter in quantity, its steel trade has remained in deficit in value. This is determined by the structure of China’s steel trade. In other words, both the technological contents and the prices of the exported steel products are lower than those of the imported steel products. In 2005, China’s trade deficit was 9.536 billion dollars, which was 17.66 percent lower than the 11.581 billion dollars in 2004 and 88.2 percent lower than the record high of 17.947 billion dollars in 2003. In the first four months of 2006, China’s net steel export was 4.3million tons, up 142 percent year-on-year. The trade deficit during this period was 800 million dollars, down 70 percent year-on-year. It is expected that for the whole year, China will be a net steel exporter in quantity and its steel trade will post a surplus in value. The current trend indicates that the surplus of China’s steel trade will continue to grow both in quantity and in value.

…

If you need the full text, please leave a message on the website.

--------------------------------------------------------------------------------

[1]. The data about steel trade except steel products and billets refer to the total amounts of the traded products specified in Chapter 72 and the products specified in 7301, 7302, 7303, 7304, 7305 and 7306 of the HS Code.