The Relationship between FDI and China’s Domestic Technological Capability

Jun 01,2006

By Lv Gang

Research Report No 004, 2006

In the past two decades, Foreign Direct Investment (FDI) has made significant contributions to China’s economic development by increasing its industrial production, exports, employment and tax revenue and by promoting the upgrade of its industrial structure. The relationship between FDI and China’s domestic technological capability (i.e. whether FDI exhibits technology spillover effect), however, has always been a highly debated topic in the academic circle. Existing empirical researches based on enterprises questionnaires are also far from conclusive. The author tries to analyze this issue by applying a regression model and conducting statistical research.

I. Definition of the Question

According to existing literature, positive effects of FDI on host countries’ technology advancement are mainly manifested in two ways, namely technology transfer and technology spillovers (or diffusion). The technology transfer from Transnational Corporations (TNCs) to their subsidiaries in China has dramatically raised the technology level of the country’s manufacturing sector in a relatively short period, but it is generally believed that the technological capacity of foreign-invested enterprises (FIEs) should not be counted as the host country’s Domestic Technological Capability (DTC). Besides, the technologies obtained by FIEs from their parent companies are for the most part those embodied in products or machinery rather than the technological ability to design, develop and produce these products or machinery. As a result, only the technological capacity of local firms is regarded as China’s DTC in this paper.

As one of the external effects of FDI, technology spillovers may boost local enterprises’ DTC via four channels. The first channel is backward and forward linkages, which refers to the connections between foreign TNCs’ affiliates in host countries and their local suppliers and customers. The second is human resource development. That is, when the employees of FIEs go to work for local enterprises, the technical skills and know-how gained from working for an FIE may spill over. Pro-competition effect is the third channel, where the existence of FIEs intensifies market competition in the host country and forces local firms to raise labor productivity and more actively adopt new technology or develop new products. The fourth channel is demonstration effect, which means that the advanced management mode or products of FIEs could be imitated by local firms.

On the other hand, FDI may also have negative effects on the development of host countries’ DTC. Firstly, local firms may become heavily dependent on imported technology and reluctant to conduct independent Research and Development (R&D). Secondly, with their advantage in terms of brands, technology and capital, FIEs may achieve monopolistic or oligopolist position in host country’s market and therefore restrain local firms’ R&D activities.

II. Technology Spillovers from FDI in China: A Cross-section Study

Quite a few foreign scholars have conducted research on the relationship between FDI and host developing countries’ domestic technological capability. A typical method is to set up a production function framework and then try to identify whether there exists a significant relationship between the ratio of FDI in industrial sectors and local firms’ labor productivity. The results, however, are far from conclusive. Some found that FDI had significant positive impact on local firms’ labor productivity and concluded that technology spillovers did exist[1]. Others claimed that there had been no significant effects of FDI on the growth rate of local firms’ productivity. They maintained that positive external effects of FDI may not take place in every industry, but are dependent on the technological capacity of local firms and the market size of host countries[2].

Most existing empirical study by domestic scholars on FDI technology spillovers in China are based on enterprise questionnaires. Recent works include Jiang Xiaojun’s investigation (2002) on 127 FIEs in Beijing, Shanghai, Shenzhen and Suzhou, and Wang Chunfa’s investigation on almost 400 FIEs in Beijing, Shanghai, Shenzhen, Suzhou and Dongguan. On the issue of whether TNCs have transferred modern technology to their affiliates in China, both scholars have come to positive conclusions. On the issue of technology spillovers, however, the results are contradictory. Jiang’s investigation showed that 58% of the sample FIEs have local suppliers, among which 69% have influenced their local suppliers by setting up quality standards for the latter, buying shares of the latter, or conducting joint investment with the latter. This suggested that backward linkages did take place in China. On the other hand, more than half of the sample FIEs in Wang’s investigation believed they have done little to enhance China’s domestic technological capability. Over 75 percent of sample FIEs have failed to set up any technology alliances with local firms; over two thirds of sample FIEs have not planned and are not planning to provide technical support for local firms.

Kokko (1994) has set up a cross-section regression model to identify technology spillovers from FDI in Mexican manufacturing industry. The author would like to follow his model to test for the existence of FDI spillovers in China.

1.Suggested model, explanations of variables and hypotheses

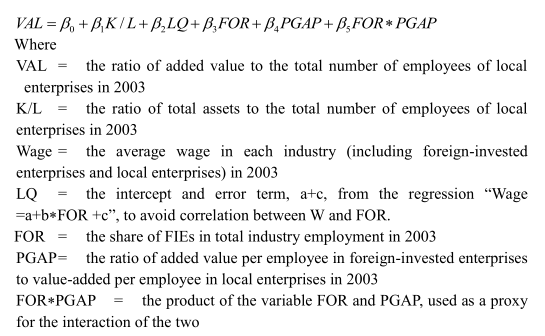

The equation is as follows:

The chief hypothesis is that if foreign presence has been found to have a significant positive effect on local productivity, then it can be concluded that spillovers take place. Variables VAL and FOR have been chosen to stand for local productivity and foreign presence respectively.

Based on the hypothesis that the ratio of FDI in a sector has to reach a certain level before it can generate technology spillovers, 11 sectors have been omitted from the sample, namelymining and washing of coal,extraction of petroleum and natural gas,mining and processing of ferrous metal ores,mining and processing of non-ferrous metal ores,mining and processing of nonmetal ores,processing of petroleum,smelting and pressing of ferrous metals,manufacture of tobacco,production and distribution of electric power and heat power,production and distribution of gas, andproduction and distribution of water.

Evidently, some of the FIEs are controlled by its Chinese partner, but since more disaggregated data are not available, all FIEs are seen as foreign-owned enterprises and all the rest of enterprises in a sector are categorized as local firms.

2. Regression results and interpretation

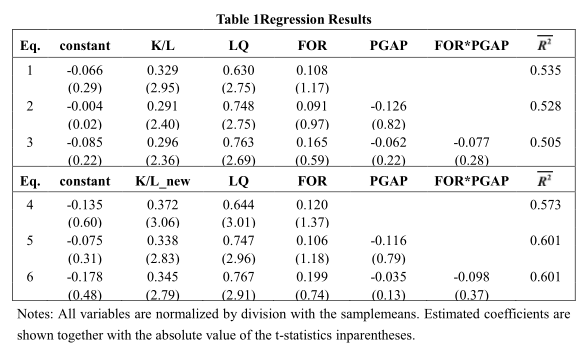

Table 1 presents the full regression results. In equation 1, both variables K/L and LQ have positive effects on the dependent variable VAL, which is statistically significant at the 5 percent level. However, the coefficient of the variable FOR is statistically insignificant, which seems to suggest that spillovers did not happen.

The variable PGAP is added in equation 2, but neither the coefficient of FOR nor that of PGAP is statistically significant. Meanwhile, the adjusted R squared decreases somewhat.

The addition of the variable FOR*PGAP in equation 3 makes little changes to the results for other variables, and the new variable itself is also insignificant.

Since asset might be a defective indicator of capital, the author also tries to use fixed asset instead of asset to calculate the variable K/L. The new series is labeled as K/L_new in table 4-9. Still, this makes little changes to the regression results, as is shown in equations 4, 5 and 6.

In summary, the regression has failed to discover any significant positive relations between foreign presence and local firms’ productivity and the results therefore should be regarded as evidence against technology spillovers from FDI in China.

Jiang (2002) has also conducted a regression study on FDI spillovers in China. Using an OLS regression to examine the relationship between foreign presence (represented by the share of FIEs in total value-added in the sector) and the growth rate of China’s 31 two-digit industrial sectors between 1991 and 2000, Jiang obtained a correlation coefficient of 0.029, which suggests that FDI has had little impact on local firms’ productivity growth and therefore indicate insignificant FDI spillovers.

…

If you need the full text, please leave a message on the website.

--------------------------------------------------------------------------------

[1] See the works of Caves (1974) on Australia, of Globerman (1979) on Canada, and of Blomström&Persson (1983) on Mexico.

[2]See the works of Haddad&Harrison (1991, 1993), Cantwell (1989) and Kokko (1994).