Suggestions on Financial System Reform in China’s Rural Areas

Dec 16,2005

Xia Bin, Ba Shusong, Gao Wei & Ma Junlu, Research Institute of Finance of DRC

Research Report No.131, 2005

At present, serious capital scarcity is threatening the sustainable development of the Chinese agricultural economy. The root cause was that after rural financial reform, the supply of rural capital was insufficient. How can one speed up the pace of financial reform in rural areas and change the passive situation? The key is figuring out the structure and characteristics of financial demand in rural areas, and working out a reform program for China’s rural financial system in the 11th Five-Year Plan period on this basis rather than putting forward separate reform plans for existing financial institutions.

I. Analysis of China’s Rural Financial Demands

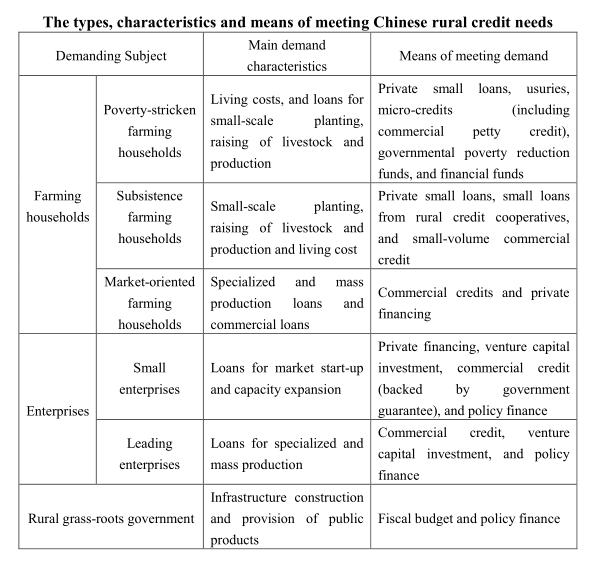

Seen from the perspective of financial services, those making demands on rural finance are farming households, rural enterprises, as well as infrastructure construction projects in rural areas. Different from rural enterprises in nature, activities and scale, farming households have multi-tiered financial demands. Divided by the characteristics of their financial demands, farming households can be categorized as poverty-stricken farming households, subsistence farming households and market-oriented farming households. Rural enterprises fall into resource-based small enterprises and leading enterprises. The form and characteristics of their financial demands, and the means which should be adopted to meet their demands, vary for subjects in these different categories.

1. Analysis of farming households’ financial demands

Poverty-stricken farming households, as a special category of people with financial demands, lack fundamental protection and living funds, and have urgent need of loans. However, they have nothing to mortgage, and thus pose a huge risk for loans. So financial institutions are reluctant to provide loans to them. In most cases, poverty-stricken farming households can only obtain small amounts of dispersed funds by special means, such as private and petty mutual-aid loans at high interest rates, aid from international financial organizations, and government poverty reduction funds.

Subsistence farming households are farming households that have preliminarily addressed their need for adequate food and clothing. These farming households, in general, are creditable, so financial institutions are relatively willing to grant them petty loans. The recovery rate for loans to such farming households is around 90%. At present, their demands for petty capital are mainly satisfied by rural credit cooperatives and micro-credit associations. However, these cooperatives are unlikely to meet all funding demands due to poor financial power.

The production and operation activities of market-oriented farming households are professional skilled production activities oriented to the market. This is the major means for farming households to increase their income and for rural areas to adjust their economic structure. Demands for loans by these farming households are generally larger than those by subsistence farming households. Similarly, they also lack collateral (farming households’ major assets, such as land, houses, and farm machine and tools, cannot be used as collateral) as required for commercial loans, so they cannot meet their loan demands from banks. According to relevant surveys, rural financial institutions can meet only 20% of the loan demand of market-oriented farming households.

2. Analysis of rural enterprises’ financial demands

The combination of "leading enterprises + bases + farming households" has been recognized as a main mode for promoting China’s agricultural industrialization because of their special industrial interaction effect and special influence on farming households’ income increases. A number of leading enterprises of a certain size have now emerged in China. These include the well-known Inner Mongolia Yili Industrial Group, Guangdong Kingman Group, Delisi Group, and the Shijiazhuang Sanlu Milk Group. These enterprises have relatively strong financial capabilities, and are also reliable borrowers with small risk. In most cases, they can obtain loans from commercial financial institutions.

Small rural resource-based enterprises constitute a large part of rural enterprises. Based on local resources, most of these enterprises grow with the aid of investment from township governments. These enterprises produce market-oriented resource products, and are almost in perfect competition. Because of large uncertainties in market supply and demand and asymmetric information, however, these enterprises have relatively big risks in production and operation, and rural financial institutions are very cautious in providing loans to them. Therefore, these enterprises are often beset with outstanding fund shortages. Some of them can obtain loans with weak guarantees from township governments. But on the whole, fund shortages have always been a bottleneck to the further development of resource-based small enterprises.

3. Infrastructure construction in rural areas

Rural infrastructure construction (except water and electric power) is a typical public product characterized by big social benefits and small economic benefits, big funding demands, long production cycle, and lack of mortgage collateral. Currently, the Agriculture Development Bank’s comprehensive agriculture development business has come to a halt, and China Development Bank’s small town development business is just at its initial stage. So there is short of organizations in rural financial systems which can provide financial services for infrastructure construction.

II. Issues in Rural Financial Supply

In practice, China’s rural financial supply consists of formal and informal financial organizations. Formal financial organizations mainly include rural credit cooperatives, the Agriculture Bank of China and Agriculture Development Bank. At the edge of some relatively developed regions, state-owned commercial banks, urban credit cooperatives and joint-stock commercial banks can also provide a few financial services to farming households and rural enterprises. Informal financial organizations mainly include private money houses, high interest rate organizations and various guilds. Such a rural financial system naturally gives rise to the following characteristics of rural resource supply:

1. Serious fund flight from rural areas

It is estimated that every year about RMB600 billion yuan is drawn away from rural areas. The channels outwards mainly include: first, branches of the Agriculture Bank of China and some other commercial banks which take a large amount of rural savings deposits, but lend only a little to farming households and small and medium-sized enterprises in rural areas, leading to an outflow of rural funds; second, rural credit cooperatives which began upon the extension of China’s unified financial market to rural areas to transfer their funds to urban financial institutions at the county level and below; third, urban credit cooperatives which lure savings from rural areas; fourth, postal savings which attract rural funds. In the four years from 1999 to 2002, postal savings deposits grew an aggregate of RMB510.6 billion yuan, of which roughly 65% came from counties and the countryside. With the approval of the State Council, the People’s Bank of China adjusted the interest rate policy for postal savings deposits on August 1, 2003, lowering the interest rate from 4.13% to 1.89%. That played a role in preventing the flight of rural funds and widening sources of credit for rural financial institutions. But it only reduced the growth rate in the flight of rural funds, and failed to reverse the trend.

2. Serious shortage of loans compared with the demands for economic development of "agriculture, the countryside and farmers"

According to statistics from the People’s Bank of China, outstanding loans for all financial institutions reached RMB17,819.778 billion yuan on December 31, 2004. This includes RMB984.311 billion yuan in loans to agriculture and RMB806.922 billion yuan in loans to township and village enterprises. Loans to agriculture and township and village enterprises, totaling RMB1,791.2 billion yuan, accounted for approximately 10% of the total, a low figure compared with their contribution to China’s GDP that year (as high as 14.6%). Statistics of the Ministry of Agriculture shows that in 2004, China’s added value of agriculture made up of nearly 15% of Chinese GDP. Loans to rural areas accounted for only 10% of the total loans of the Agriculture Bank of China.

…

If you need the full text, please leave a message on the website.