Private Enterprises Should Be the Main Player on Company Bond Market

Sep 01,2005

Guo Lihong, Department of Techno-Economic Research of DRC Research Report No.105, 2005

According to "Some Guidelines on Promoting the Reform and Opening up and Steady Development of the Capital Market" (issued by the State Council in January 2004 and referred to in short as the Nine Articles of the State Council hereinafter), the tasks to promote reform and steady development of the capital market should be based on "the objectives of increasing direct financing, improving the modern market system and further expanding the basic role of the market in resource allocation."

These are difficult objectives as they require a big leap from "government-based resource allocation" to "market-based resource allocation" through system reform.

I. Resource Allocation onBond Market in China Is Government-based

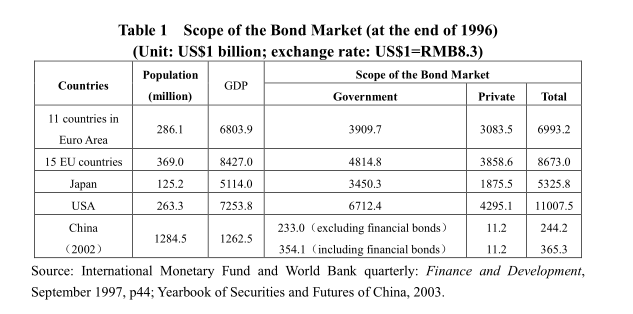

According to international statistics, bonds are divided into two major categories, namely government bonds and private bonds. Private bonds refer to company bonds of a non-government nature. In China, however, company bonds are mainly issued by state-owned enterprises, hence they are difficult to be classified as "private bonds."

In foreign countries, bonds issued by financial institutions do not vary in nature with bonds issued by industrial and commercial enterprises, which all belong to the category of company bonds. In China, however, all bonds are issued by solely state-owned financial institutions with authorization of the central government, no matter if they are aimed at supplementing state capital (such as when establishing the State Development Bank and the Asset Management Company), or increasing fund liquidity and expanding business scale. In fact, they are government bonds with Chinese characteristics.

With the above differentiation, it is now possible to make an international comparison if we still regard company bonds as private bonds and financial bonds as government bonds. The comparison in Table 1 shows that in terms of the bond structure, there were always more government bonds than private bonds. However, in market economies, the gap is only 1.2 times (EU) to 1.9 times (Japan), while it was as large as 20.8 times (excluding financial bonds) to 31.6 times (including financial bonds) in China.

This huge difference clearly indicates that as resources in other financial areas, resources in the bond market are allocated by the market in developed countries whereas they are allocated by the government in China.

If we are to follow the ideas of the Nine Articles of the State Council to "further expand the basic role of the market in resource allocation", we must differentiate state-owned enterprises from private enterprises in terms of company bonds.

II. Precondition for Expanding Company Bonds of State-owned Enterprises: Establishing an Investor Credit Management System

With the long delayed investment and financing system reform and the inertia effect of soft budget restriction, many state-owned enterprises only care for borrowing without thinking about their ability to repay the loans. According to the investigation of the Investment Department of the State Planning Commission on investment results of state-owned large and medium-sized projects in Shandong Province during the Eighth Five-Year Plan period, only 5% of the projects were fully able to service their debts. The significance of this example is that although the management of large and medium projects was most strict and the management level of Shandong Province was advanced in China, there were still 95% of the projects unable to service their loans, not to mention achieving investment returns. It demonstrated the extent of the low levels of investment efficiency and credit awareness of the state-owned enterprises, which has not changed fundamentally so far.

However, it is wishful to think that state-owned enterprises only dare to default on bank lending and not on bonds. State-owned enterprises that do not have the basic concept of the market economy of repaying their borrowing will not change their concept fundamentally when utilizing direct means of financing.

During the period starting from 1987 when the "Provisional Regulations on Enterprise Bond Management" was issued by the State Council to 1993 when the Company Law was implemented and to 1999, the People’s Bank of China (PBC) was responsible for examining and approving issuance of all enterprise bonds (company bonds) and all bond issuers were state-owned enterprises. There are no statistics showing repayment in general of these bonds. However, the report of ZhuRongji at the Party School of CPC Central Committee in June 1997 (the author reviewed the notes and will bear the responsibility) revealed that "It is very difficult to unify our thoughts on direct and indirect financing. Some people propose to accelerate the opening up of direct financing. This is because they do not understand Chinese conditions and the situation now is very difficult to handle. We are not even able to repay enterprise bonds already issued. Liaoning Province issued RMB3.8 billion enterprise bonds, but can only repay RMB72 million. These bonds were all sold by banks on commission. Therefore, the main issue at present is to develop indirect financing. We cannot open up direct financing without a relevant legal system."

After 2000, the authority to approve issuance of company bonds was transferred to the State Planning Commission. However, all approvals were given to state projects, which actually equaled to government bonds. First, the newly established Project Company did not have any credibility, and the actual fund-raisers are governments at various levels behind the projects. Second, people did not differentiate projects from government and bought the bonds for their trust in the government. The State Planning Commission adopted two management methods. First, although the bonds were used for government projects, they must be issued by large security companies in their own names, turning the issuers into bond dealers in effect. Second, it rigorously required commercial banks to issue guarantees so as to let banks bear the ultimate risks of direct financing.

We can see from time to time the responsibility cycle of the government in resource allocation. In this cycle, loans issued by the State Development Bank must be guaranteed by local governments; company bonds approved by the Development and Reform Commission must be guaranteed by state-owned commercial banks; while convertible bonds approved by the State Securities Regulatory Commission must also be guaranteed by state-owned commercial banks. Although all government departments have the means to shirk their responsibilities, responsibilities for financial risks are ultimately born by the state. This cycle of guarantee reflects the lack of confidence in the credit standing of government capital.

In market economies, credibility and timely performance of various contracts are basic conditions of normal operation of the overall economic system, and the concept of "credibility" of credit relations rose therefrom. In broad terms, all market players, including states (sovereign credibility) at the top and citizens (private credibility) at the bottom, achieve their credibility via their ability to perform various economic commitments. Market economies have open financial markets and frequent investment lending. The possibility of investors to invest and the cost of investment are decided only by their credibility. Therefore, credibility is the information channel and interface between investors and financing.

As government decides various issues of state-owned enterprises, such as asset restructuring, separation and merging as well as bankruptcy registration and asset allocation, it is not necessary to rate enterprise credibility. What is necessary though is to evaluate government capital behind an enterprise. Based on the state asset management system set up according to the proposal of the Sixteenth Party Congress, future government investors will mainly consist of one state assetsmanagement commission, 31 provincial state assets management commissions and 265 (prefecture) municipal assets management commissions. To establish credit management, it is necessary for the PBC, whose responsibilities are already separated from that of China Banking Regulatory Commission, to rate the respective credit standings of these 300 fund providing agencies based on the bad-loan records of all large banks, including commercial and policy banks and the results of credit standing should be made known to the public each year.

Only after the establishment of the credibility management system of investors can we open up company bonds of state-owned enterprises based on credibility information.

…

If you need the full text, please leave a message on the website.