Solution of Structural Contradictions and Improvement of Investment Environment to Promote Sustainable and Steady Economic Growth

Sep 11,2002

Zhang Junkuo

Research Report No 072, 2002

I. Economic growth still presents a general trend of continuous slowdown and the potential of growth is to be fully tapped.

In spite of the adoption of an expansive financial and monetary policy by the Chinese Government for consecutive years, which has saved the Chinese economy from sharp fluctuations and kept it a fast growth, the speed of growth has never turned off the general trend of continuous slowdown and the potential of growth has not yet been fully tapped.

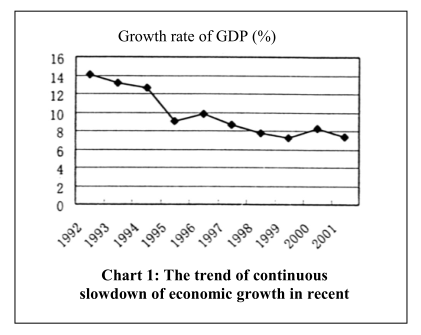

It can be seen from Chart 1 that the growth of the Chinese economy has kept slowing down since 1992. This process should not be taken up in the lump. Instead, it should be studied specifically. In 1992, the annual growth rate jumped over 14 per cent, a rate of obvious economic overheating. In view of the situation, the Central Government took strict measures of macro-regulation including adoption of administrative measures such as strict control over bank lending and scale of fixed assets investment. For this reason, the slowdown of growth during this period of time was a normal response to the measures of macro-regulation and a normal fall after overheating of the economy. The continuous slowdown of economic growth since 1997 is, however, obviously different. During this period of time, the Central Government has shifted to an expansive financial and monetary policy to increase domestic demand and stimulate the economy as a whole. Except for a slight rebound in the year 2000, growth of the Chinese economy has kept slowing down in general terms.

The immediate cause of the continuous slowdown of economic growth has been insufficient market demand. Products are unmarketable, and large amounts of production capacities remain idle, especially in the general processing industry. There has been no new hot spot of consumption at the market, and enterprises have had no way to find any good projects for investment. Why has China suffered serious deficiency of market demand and tremendous surplus of production capacities when it has just reached a fairly primary stage of development? To answer this question, it is necessary to make further study of the factors leading to the fall of general demand.

II. Slowdown in the growth of consumption demand of rural residents and the demand for non-governmental investment--two major factors restricting growth of domestic demand

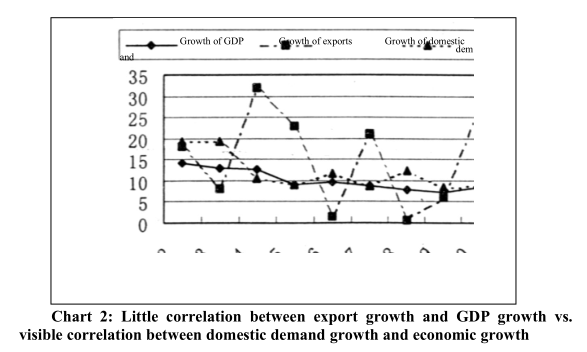

Demand can be divided, first of all, into domestic demand and overseas demand. Undoubtedly, the Asian financial crisis in 1997 and its serious influence upon China’s exports have constituted an important factor causing the slowdown of growth of overall demand. In 1998, for instance, China’s exports grew by merely 0.5 per cent. For a big country like China, domestic demand will always play a decisive role in the economic growth, from a long point of view, the influence of export growth on the economic growth as a whole will be comparatively smaller (as shown in Chart 2).

Domestic demand can be further divided into demand of consumption and demand of investment.

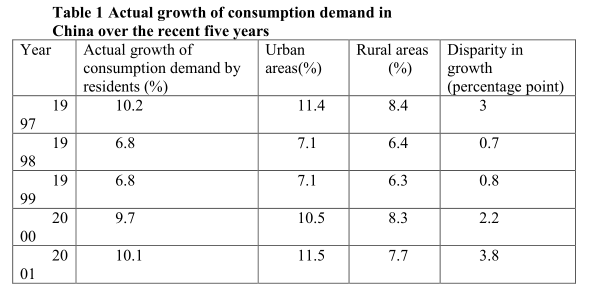

From the angle of demand of consumption, the retail of consumer goods in China’s urban areas stood at RMB631.4 billion in the first quarter of the year 2002, an increase of 9.3 per cent over the previous year. Retail sales of consumer goods in the rural areas were RMB372.1 billion during this period of time, up by 7 per cent and 2.3 percentage points below the figure for the urban areas. With regard to the situation over the recent five years, the slowdown in consumption demand growth has its root mainly in the rural areas, as indicated in Table 1.

Note: The absolute figure for domestic demand is the sum of domestic investment and domestic demand calculated in current price, with readjustment made according to the average index of national income during the calculation.

It can be clearly seen from Table 1 that growth of consumption demand in China’s rural areas has always lagged behind that in its urban areas. Since 1998, in particular, the gap between growth of consumption demand at the rural market and the urban market has widened constantly rather than narrowing. As the situation stands, the emphasis of the policy to increase domestic demand of consumption should be put on creating and promoting the demand at the rural market, in addition to maintaining a comparatively fast growth of consumption by the urban residents.

With regard to the investment demand, the Chinese Government has issued long-term construction bonds for years running after the Asian financial crisis to expand the scale of investment by way of direct government investment. By 2001, China issued a total of RMB 510 billion worth of treasury bonds. Plus supplementary funds from banks, total investment by the Chinese Government exceeded RMB 2,500 billion. Although the growth rate of investment as a whole has maintained a comparatively fast speed due to the direct government investment, the results in spurring non-governmental investment have not been so encouraging. In the first quarter of 2002, total fixed assets investment by the society as a whole was RMB 467.2 billion, 19.6 per cent more than a year ago. This growth rate was 7.2 percentage points higher than the figure for the same period of last year. Of this total, investment by enterprises and institutions of State ownership and other ownerships (excluding collective and private investment in the real estate industry) stood at RMB 304.9 billion, 25.1 per cent up from the year before. Investment by collective and private enterprises, meanwhile, came to RMB71.7 billion and RMB90.7 billion respectively, climbing up by 12.6 and 9.1 per cent respectively.

III. Structural contradictions are the root cause of insufficient domestic demand.

1. Structural contradictions of agriculture and demand of consumption in the rural areas

Further analysis has revealed that a major cause of slowdown in consumption demand growth in rural areas has been the obvious fall of the income of the rural residents behind that of the urban residents in recent years. As shown in Table 2, income growth of rural residents has been slower than that of the urban residents in all years except 1997, when the former outpaced the latter by one percentage point. Also, the gap has remained big. In the recent three years, in particular, the gap has more than doubled.

...

If you need the full context, please leave a message on the website.