Judgments of Entrepreneurs on Macroeconomic Situation and Hot Issues -- Based on Questionnaires for Chinese Entrepreneurs Survey Report 2001

Feb 15,2002

China Entrepreneur Survey System

Research Report No 212, 2001

The Chinese entrepreneurs survey 2001 was organized by the Chinese Entrepreneurs Survey System under the Development Research Center of the State Council. A total of 15,000 questionnaires were issued in mid-August 2001, of which 4,695 copies were responded. The responded samples covered all of China’s 31 provinces, autonomous regions and municipalities directly under the central government, except Hong Kong, Macao and Taiwan. Of the surveyed enterprises in various industries, state-owed and non-state-owned enterprises respectively accounted for 31 percent and 69 percent, and the large, medium-sized and small enterprises respectively accounted for 22.3 percent, 50.3 percent and 27.4 percent. Board chairmen, general managers, chief executive officers, factory directors and Party secretaries accounted for 95.6 percent of all the people surveyed.

The topics entrepreneurs were asked to comment on macroeconomic situation included economic development trend and corporate production and governance. As for the hot economic issues, the survey covered corporate system change, economic restructuring, market economic order regulation and China’s WTO accession.

The survey findings indicate that due to the impact of the rapid economic downturn in the United States and Japan, China’s export grew at a visibly slower rate this year. But most entrepreneurs believed that in general China’s macroeconomic performance still maintained a steady growth and corporate performance were good. Most entrepreneurs were confident about the prospects of economic development in the near future. At the same time, however, entrepreneurs believed that problems such as sagging effective demand and financing restraints were still impeding the development of enterprises and that the economic efficiency of enterprises still needed to be further improved. Survey findings also show that the reform of corporate systems reported steady progress nationwide this year and the shareholding enterprises operated well. Entrepreneurs believed that the emphasis of China’s ongoing economic restructuring was to develop high- and new-tech industries and to upgrade and transform traditional industries. They believed that human development and technological innovation constituted the key to coping with China’s WTO accession and to increasing the international competitiveness of enterprises. At the same time, they believed that corporate governance needed further improvement and hoped that the government could further regulate market economic order, intensify law enforcement and standardize corporate behaviors.

I. Macroeconomic Operation Maintained Steady Development.

Last year, China’s macroeconomic operation reported a major improvement. This year, however, the demand for China’s exports was visibly weaker due to the economic downturn in the United States and Japan. Survey findings indicate that most entrepreneurs still believed that, in general, macroeconomic operation still maintained a steady development.

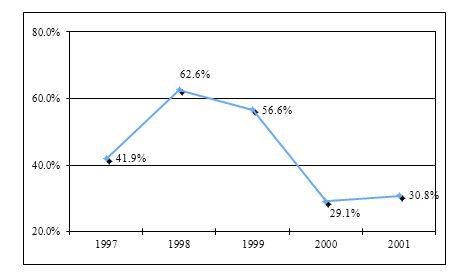

As far as macroeconomic situation is concerned, 44.4 percent of entrepreneurs believed that the situation was “normal”. Only 30.8 percent of them believed the situation was “rather cool” or “too cool”. This proportion is roughly identical with that in last year’s survey, but markedly lower than the 56.6 percent in the 1999 survey. This is an indication that entrepreneurs believed that China’s macroeconomic operation this year has largely maintained the good development trend since 2000 (see the following figure).

Figure 1 Proportion of Entrepreneurs Believing Macroeconomic Operation Was “Rather Cool” or “Too Cool” in Recent Years

With regard to export, survey findings indicate that 67 percent of entrepreneurs believed that the demand for China’s export was “insufficient”, 18.1 percentage points higher than that in last year’s survey.

As to domestic demand, thanks to the impact of a series of active financial policies of the government, this year saw some improvement in the insufficient consumption demand and the demand for fixed asset investment. 51.0 percent, or 12.4 percentage points less than that in last year, of entrepreneurs believed that consumption demand was still “insufficient”.

Survey findings indicate that more than two-thirds of entrepreneurs believed that government investment was “proper”, while less than one-third of respondents believed government investment was “insufficient”. On the other hand, more than half, 51.5 percent, of entrepreneurs believed that demand for private investment was “insufficient”. Specifically, 45.5 percent in the east region, 56.4 percent in the central region and 60.7 percent in the west region held this opinion. Therefore, how to boost private investment should be an important aspect in further expanding demand for fixed asset investment.

II. Corporate Operations Maintained Good Development.

(I) General State of Corporate Operations

This survey classifies entrepreneurs’ views on their current corporate operations into three categories: “good”, “average” and “poor” and their views on future corporate operations are also classified into three categories: “improving”, “unchanged” and “worse”. Survey findings indicate that 35.9 percent of entrepreneurs believed their current corporate operations were “good”, 47.2 percent, “average” and 16.9 percent, “poor”. Those believing “good” were 19 percentage points higher than those believing “poor”, largely the same as that in last year’s survey.

In terms of economic type, the enterprises with investment from foreign countries, Hong Kong, Macao and Taiwan as well as the limited liability companies and the private enterprises operated relatively well.

In terms of scale, large enterprises operated better than medium-sized and small ones.

In terms of regional distribution, those in the east region operated better than those in the central and west regions (see Table 1).

|

|

Current |

Future | ||||||

|

Good |

Average |

Poor |

Good-Poor |

Improving |

Unchanged |

Worse |

Improving-Worse | |

I. Overall |

35.9 |

47.2 |

16.9 |

19.0 |

41.8 |

47.4 |

10.8 |

31.0 |

|

State-owned enterprises |

29.3 |

48.6 |

22.1 |

7.2 |

37.5 |

48.65 |

13.9 |

23.7 |

|

Of which: large |

35.8 |

50.4 |

13.8 |

22.0 |

41.9 |

46.7 |

11.4 |

30.5 |

|

medium-sized |

27.7 |

45.6 |

26.7 |

1.0 |

36.3 |

47.3 |

16.4 |

19.9 |

|

small |

23.4 |

54.3 |

22.3 |

1.1 |

33.5 |

55.5 |

11.0 |

22.5 |

|

Collective enterprises |

26.7 |

53.6 |

19.7 |

7.0 |

40.8 |

46.0 |

13.2 |

27.6 |

|

Private enterprises |

40.9 |

43.2 |

15.9 |

25.0 |

43.8 |

49.7 |

6.5 |

37.3 |

|

Joint-stock enterprises |

38.8 |

45.4 |

15.8 |

23.0 |

37.3 |

52.5 |

10.2 |

27.1 |

|

Limited companies |

43.3 |

43.3 |

13.4 |

29.9 |

45.3 |

45.0 |

9.7 |

35.6 |

|

Limited liability companies |

37.2 |

49.1 |

13.7 |

23.5 |

46.0 |

45.6 |

8.4 |

37.6 |

|

Enterprises with investment from foreign countries, Hong Kong, Macao & Taiwan |

49.4 |

38.3 |

12.3 |

37.1 |

40.7 |

48.6 |

10.7 |

30.0 |

|

Large enterprises |

40.1 |

46.9 |

13.0 |

27.1 |

43.5 |

46.4 |

10.1 |

33.4 |

|

Of which: state-owned |

37.0 |

47.4 |

15.6 |

21.4 |

39.3 |

50.2 |

10.5 |

28.8 |

|

state-held |

37.3 |

48.1 |

14.6 |

22.7 |

42.6 |

45.5 |

11.9 |

30.7 |

|

non-state-owned |

46.9 |

44.6 |

8.5 |

38.4 |

47.6 |

44.9 |

7.5 |

40.1 |

|

Medium-sized enterprises |

37.4 |

44.9 |

17.7 |

19.7 |

42.6 |

46.2 |

11.2 |

31.4 |

|

Small enterprises |

29.8 |

51.7 |

18.5 |

11.3 |

39.2 |

50.0 |

10.8 |

28.4 |

|

Enterprises in east region |

40.5 |

46.0 |

13.5 |

27.0 |

42.1 |

48.4 |

9.5 |

32.6 |

|

Enterprises in central region |

31.1 |

50.0 |

18.9 |

12.2 |

41.5 |

47.7 |

10.8 |

30.7 |

|

Enterprises in west region |

30.3 |

47.0 |

22.7 |

7.6 |

41.3 |

44.4 |

14.3 |

27.0 |

In terms of industrial sector, the industries of pharmacy, special equipment, power generation and facilities of communications and transportation operated well while the industries of wholesale, retail, textile and non-ferrous metal operated relatively badly, and the petro-chemical industry operated even worse (see Table 2).

...

If you need the full context, please leave a message on the website.