Analysis and Prospect of the Foreign Trade Situation in China

Feb 15,2002

Long Guoqiang

Due to negative influences from the deterioration of the international economic situation, China saw marked drops in both imports and exports this year compared with the previous year. In this article, the author analyses the foreign trade situation in China this year and looks into the prospect of the country’s foreign trade situation for the year as a whole and for the coming year by taking into consideration the development of the world economy and the new situation arising from China’s entry into the World Trade Organization.

I. Basic Characteristics of Development of Foreign Trade in China in the Year 2001 1.

Simultaneous Deceleration of the Growth of both Imports and Exports and Marked Reduction of Trade Surpluses

From January to September of 2001, China’s exports totaled US$194.98 billion, 7% up from the same period of the previous year. Its imports, meanwhile, amounted to US$181.39 billion, growing by 11.2%. This ended in a trade surplus of US$13.59 billion, US$5.61 billion or 29.2% less than the same period of the previous year.

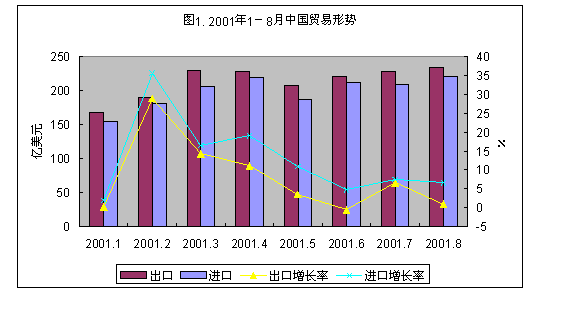

If analyzed on a monthly basis, exports grew in all the months except June, when exports saw a marginal negative growth. Since February, however, the speed of growth began to decelerate from month to month. The growth of imports was basically the same as that of exports, although with 4 or 5 percentage points faster than the latter. (Graph 1)

2. Decrease in Exports by State-owned Enterprises and Strong Growth of Exports by Enterprises of Other Ownership

In the year 2000, China’s State-owned enterprises saw their exports grow by a rate of 18.2%. In the first eight months of the year 2001, however, they saw negative growth of exports in both general trade form and processing trade form, with the total value of exports falling by 3% from the same period of the previous year. The proportion they take in the country’s total value of exports also shrank from 46.6% at the end of the year 2000 to 43.5% by August, 2001. In comparison, exports by foreign-invested enterprises maintained a growth rate of 13.4% in spite of deterioration of the international market situation. Exports by collectively-owned enterprises and enterprises of other ownership, meanwhile, grew by as much as 36.8% and 93.6% respectively due to comparatively small base figures. What should be pointed out here is that imports by foreign-invested enterprises for processing trade grew by merely 0.6%, while the growth of exports hit as much as 10.5%. This indicated a noticeable rise of value-added rates in China. It can be seen from the comparison made above that State-owned enterprises are comparatively poor in terms of adaptation to fluctuations at the international market, and still have much to do to sharpen their competition edge at international markets. Growth of exports of traditional products was weak, while exports of electro-machinery and hi-tech products were brisk.

Since the current round of global deceleration of economic growth has resulted from market surplus of IT products, traditional products should not have been affected so much. In China’s case, however, exports of traditional products slackened, with the growth rate of textile raw materials and textile products, shoes, headwear, and other bulk traditional products standing at between merely 0.7% and 3.3%, and that of some textile products falling below zero in the first eight months of the year 2001. In comparison, the trade of electro-machinery and hi-tech products was extremely brisk, with exports growing by 13.7% and 25.1% respectively. Since exports of these two categories of products have been conducted in the form of processing trade, their growing indicates that the growth of the aggregate volume of China’s trade and the improvement of structure is attributable mainly to the development of processing trade in the country.

3. Strong Growth of Exports in the Eastern Region and Some Provinces and Municipalities in the Western Region and Big Fall of Exports in the Southern and the Northeastern Region

The development of foreign trade in different parts of China has varied. The provinces and municipalities in the Eastern Region maintained strong growth momentum. Zhejiang Province, for instance, saw a growth of 20.4%; Jiangsu, 13.8%; and Shanghai, 14%. Some areas in the Western Region also saw high-speed growths. Chongqing achieved a 38.5% growth; Qinghai, 50.7%; and Gansu, 20.8%. What has been eye-catching, however, is that growth of exports in the Southern Region and the Northeastern Region decelerated substantially. Heilongjiang Province even reported a negative growth rate, -6.7%. Guangdong Province, which contributes one third to China’s exports, saw a growth rate of merely 0.9% in the first eight months. Shantou, a city in Guangdong Province, suffered 58.7% drop in exports. This indicated that nonstandard business operations would harm exports enormously. Slow growth of exports from Guangdong Province has constituted a major factor in the substantial deceleration of the growth speed of China’s exports.

4. Balanced Growth of Exports to Major Markets, and Initial Success in Tapping New Markets

It is apparent that China’s exports are subject to influences from changes in demands at imports markets. In the first eight months of the year 2001, China’s exports to Japan, Europe and the United States, three of its major export markets, grew by 10.8%, 9% and 4.9% respectively. The US economy suffered the biggest deceleration of growth speed in the previous year. Correspondingly, China’s exports to the United States suffered the biggest fall. In a situation of sluggish markets in developed countries, the Chinese Government and the Chinese enterprises have made vigorous efforts to open up the markets in developing countries and achieved noticeable results. The growth rate of China’s exports to Africa and Latin America, for instance, stood at 21% and 16.8% respectively. What is worthy of attention is that China’s exports to and imports from Hong Kong grew by merely 2.2% and 3.9% respectively. This indicates that with the improvement of port facilities and circulation services on the Chinese mainland, Hong Kong has come down correspondingly in its position as a trade intermediary.

II. Basic Factors Affecting China’s Situation in Foreign Trade

The characteristics of China’s foreign trade in the year 2001, as described above, have resulted from the joint action of many factors, including the following basic factors:

First of all, growth of the world economy has slowed down. Since the latter half of the year 2000, the US economy decelerated enormously. The European economy became weak in the year 2001, and the Japanese economy continued to dive even deeper into mire. This is the first time since 1990 for the growth rate of the three major economies to slow down simultaneously. The influences of the slowdown have far outgrown those from the Asian financial crisis. China has become the world’s 7th biggest exporting country. Slowdown of the world economy has contained the growth of external demands, and become a major factor to blame for the slowdown of China’s exports. Since about half of China’s exports are executed in the form of processing trade, slowdown of exports has resulted in a slower growth of imports in the form of processing trade.

...

If you need the full context, please leave a message on the website.