Yili market value exceeds 200 billion yuan

The stock price of Yili Industrial Group, a dairy giant in China, closed at 33.53 yuan ($4.89) Jan 16. The dairy company currently has a market value of 204.4 billion yuan.

Official data showed that since the adoption in September 2019 of the share incentive plan, which provides statutory tax relief for employees directly acquiring shares in their company, Yili’s shares have risen 19.39 percent, continuing to lead the Asian dairy industry.

At the same time, Yili's operating performance also maintained stable momentum in both revenue and net profit.

As a dairy giant in China's A-share market, Yili has led the industry in terms of net profit, with the latest third-quarter financial report showing total revenue is 68.677 billion yuan and net profit is 5.648 billion yuan.

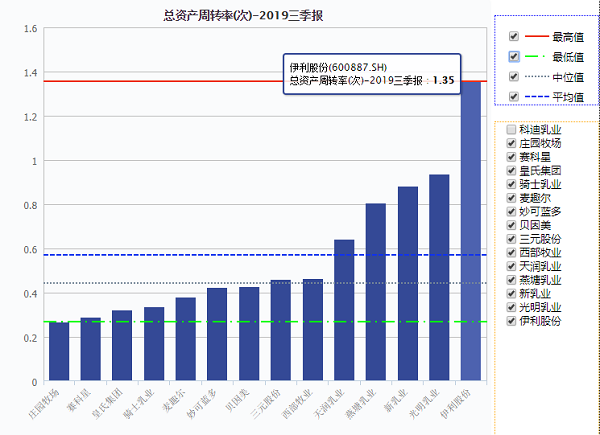

The report also shows that thanks to Yili's outstanding management ability, the total asset turnover rate has reached 1.35 times, ranking first in the domestic dairy industry.

In 2019, Yili launched a new restricted stare incentive plan, aligning the company's interest with all investors, enhancing management efficiency and reducing premium costs.

Since the implementation of the plan, Yili's stock price has risen by 19.39 percent.

According to the latest survey conducted by Wind, a financial information service provider in China, Yili is expected to achieve revenue growth of 12.21 percent in 2020 and 10.92 in 2021.

According to officials, the institutional investor's position in Yili shares is as high as 41.02 percent, and foreign investment from institutions such as the Morgan Stanley Capital International is also increasing.

Yili Industrial Group's latest third-quarter financial report shows that the company's total asset turnover rate has reached 1.35 times, ranking first in the domestic dairy industry. [Photo provided to chinadaily.com.cn]

Yili is expected to achieve revenue growth 12.21 percent in 202 and and 10.92 percent in 2021, according to the latest survey conducted by Wind. [Photo provided to chinadaily.com.cn]