Local government's guarantees boost financing options

Weifang Hi-tech Industrial Development Zone is providing more financial

support to outstanding local businesses to boost their development.

The zone released a guideline in 2016, supporting small and medium-sized enterprises that have high growth potential in the region.

The zone's authorities then identified those SMEs that have financial needs and classified them into three types - A, B and C - according to their tax payment records, bank credit and other measurements.

"A-type businesses have independent intellectual property and sustainable

research and development capacity. They have core competitiveness and strong

growth potential," said Zhang Xia, director of the zone's investment and

financing management service center. "Those companies are taking steps to find

shareholders or list on a stock exchange. They have high credibility and have

attracted investors."

Zhang said A-type companies will enjoy priority in obtaining government support, such as risk compensation and financial guarantees.

Two companies in the zone were listed as A-type companies.

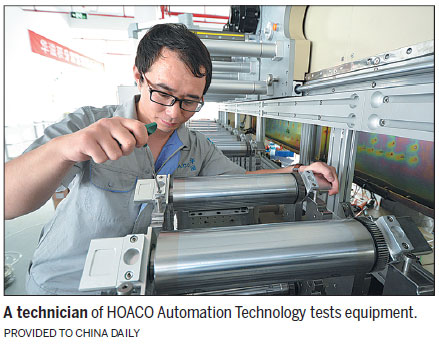

HOACO Automation Technology, a precision equipment manufacturer, was one. Guaranteed by the zone, HOACO obtained a 20 million yuan ($3 million) bank loan in August this year.

"We achieved 50 percent production output value growth in 2016. However, we cannot serve market demand because we do not have sufficient production capacity," said Tian Rouxin, assistant to the general manager at the company.

Tian said that HOACO is an asset-light technology company that does not have much collateral to secure loans.

"We could obtain no more than a 4 million yuan bank loan even if we found guarantees, which could not solve our company's problems," Tian said.

Supported by the high-tech zone's government, HOACO finally received the necessary bank loans without collateral. The zone's finance office joined hands with a local privately-owned credit re-guarantee company to provide the guarantee for HOACO.

"We are the first company in the zone to obtain loans under this new model. We are satisfied with the results," Tian said.

Many companies in the zone have obtained funds under the zone's new service model.

"Model innovation is very important in supporting financial technology development," said Zhang. "We are exploring ways to give rational and professional support to promising businesses so we can better use limited government and financial resources."

Zhang said the zone works continuously to improve its business environment and develops new policies to serve companies' financial demands. The efforts will encourage businesses to participate in capital market exploration.

Guo Yajing contributed to this story.

(China Daily 11/07/2017 page12)